Flashback summer 2022/23 – Queues at electric vehicle charging stations

In the summer of 2022/23, Australian electric vehicle (EV) drivers, many of whom were excited to try out their new vehicles on summer holiday trips, faced extended wait times and frustration accessing functional chargers or waiting for one to become available. Last summer was the first where enough EVs were on the road during the peak holiday period to cause delays at charging stations. Some EV drivers were caught up in 90 minute queues to use a charger [1-2] and get back on the road.

Source: [2].

The lack of chargers was compounded by poor planning and budgeting for maintenance, supply chain disruptions (related to the COVID-19 pandemic), and weather impacts on charging infrastructure (flooding) in some parts of the country in 2022 [3]. Such delays while on holiday are annoying, but they could be the tip of the melting icecap ahead of more widespread adoption of EVs for everyday driving, business trips, or commercial operations where time is a critical factor.

Electric vehicle uptake and public fast charger availability since summer 2022/23

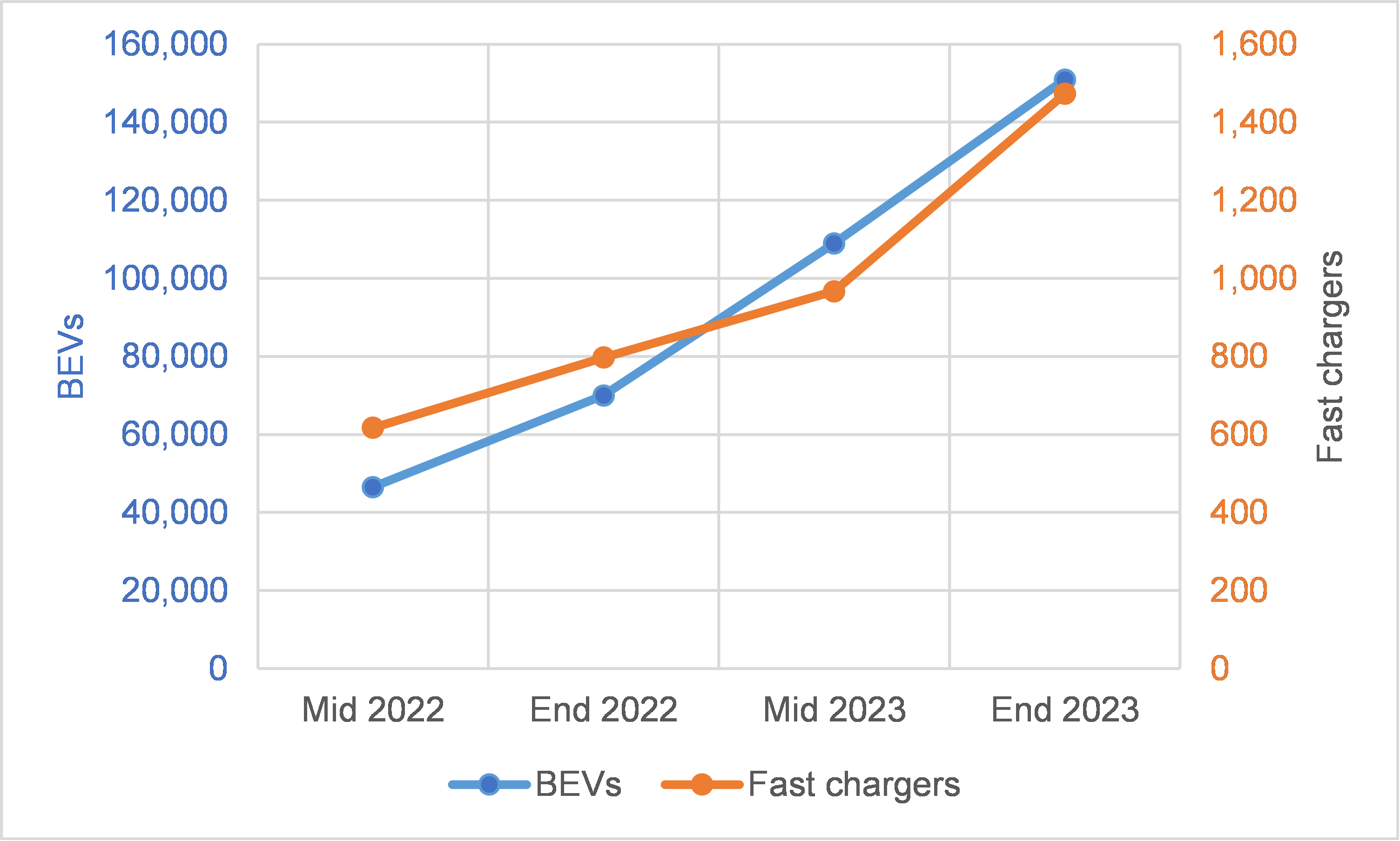

Since the 2022/23 summer, EV uptake across Australia has increased significantly. The Electric Vehicle Council (EVC) estimates that, as of June 2023, there were about 130,000 EVs registered in Australia, 109,000 of which were battery-electric vehicles (BEVs) [4] that are reliant on charging infrastructure. This means the number of BEVs more than doubled in one year from June 2022. The EVC also estimated that EV numbers will grow to around 180,000 by the end of 2023. In the first half 2023, 43,092 new BEVs sold, compared to only 33,416 in all of 2022. This means there will be more than 150,000 BEVs on the road by time we get to the 2023/24 summer holiday period.

While BEV users often charge their vehicles at home or at work, while on longer trips, they rely on accessible public fast charging infrastructure. In June 2023, there were 558 public fast charging locations nationwide, with a total of 967 chargers [4]. This is a 57% increase in fast charging locations compared to June 2022 (356 locations), i.e. significantly less than the increase in EVs on the road. The result is a widening gap between the numbers of EVs and chargers between mid-2022 and mid-2023., as shown by the steeper BEV curve compared to the fast charger curve during this time (Figure 1).

Figure 1 Number of BEVs and fast charging stations in Australia

Note: Estimations based on [4-6].

Fortunately, recent data about available fast charging locations in Australia suggests that the pace of rolling out fast chargers is picking up [7]. Based on current trends, NTRO estimates that there could be 850 fast charging locations with more than 1,400 chargers ready for use by this summer (2023/24). If charging sites increase in size, i.e. there are more chargers per site, which is likely taking into account the pace of EV uptake and future fast charging needs, the number of available chargers this summer could be even higher.

While the overall number of EV charging points is far higher (more than 2,000 as of last year [6]), these additional chargers provide slower charging and do not allow drivers to top up quickly on-route. Additionally, less than a quarter of the fast charging locations in June 2023 offered ultrafast charging at a power of 100 kW or more [4]. This limits the ability for drivers to top up quickly on-route.

Predictions for the summer 2023/24 charging considering increased EV uptake

Despite the growth in public EV charging infrastructure, the uptake of EVs has been outstripping the rollout of charging infrastructure. During the 2022/23 summer, the ratio of BEVs per public fast charger was around 90:1, i.e. one public fast charger for 90 BEVs on the road [4-6]. On current projections, this ratio could increase to about 100:1 this summer if the number of chargers increase in line with the number of new charging locations. We could see a slightly better BEV-to-fast charger ratio if the number of fast chargers per site increases, or if less chargers are out of service.

In summary, it seems unlikely that we will see improvements this year compared to last year’s EV charging situation during the peak season. Last year’s 90:1 ratio which caused charging delays could already be out of reach this year. This indicates that a similar EV charging situation could be expected during the coming summer holiday period, continuing the frustrations of holiday makers using their EVs to travel.

Solutions for the future

So, what does this mean for the future? To answer this question, the following key recommendations for the effective rollout of public EV charging infrastructure should be considered [8]:

- Breaking down silos, especially between the power, transport and urban planning sectors. This includes facilitating discussions between institutions and jurisdictions, and reorganising existing institutional structures.

- Tailoring the rollout strategy. Obtaining relevant transport and associated data is a key element of the strategy as it allows to identify EV types, user behaviour and associated information.

- Attracting investments by signalling that the transition to EVs is a priority. This includes streamlining approvals and permitting processes, which has been a source of delays to the installation of EV charging infrastructure.

- Encouraging standardisation. This ensures that reliable information is available about chargers and pricing, and interoperability across charging networks can be ensured. Tenders and support measures should have performance requirements to guarantee high-quality charging service outcomes.

- Futureproofing the approach. This means that future vehicle fleet and transport strategies need to be considered, along with smart charging, scalability of charging and electricity networks, and the supply of electricity form renewable sources.

What has Australia done in this space?

Referring to point 1, state and territory governments in Australia are partnering with industry players to accelerate the rollout of fast EV charging infrastructure under various funding programs. Most jurisdictions have published information about their EV infrastructure rollout plans [4], and NRMA is planning to install EV chargers at 130 locations nationwide [9]. However, there is still a lack of a more coordinated national approach.

Referring point 2, a national database has been announced in Australia’s National Electric Vehicle Strategy released earlier this year [10], but is not yet available. Consolidating details about charging infrastructure in a national map, platform or database is important for planning investments and for user accessibility. Internationally, this has been a key element of charging infrastructure rollout and investment, e.g. in Germany [11] and Norway [12], by gathering information about chargers and charging locations, and communicating it effectively to third parties.

Referring to point 4, requiring charging station operators to accept payment via conventional contactless (card) payment systems has been regulated in some countries (e.g. in Germany [13]). This form of standardisation makes EV chargers more accessible and convenient to use. A comparable regulation is not yet implemented in Australia.

NTRO

NTRO can assist with the above challenges that our transport systems face. We are working in close collaboration with all Australian state and territory transport agencies, and we can help with investigating options to transition to a low-carbon emissions transport future, in road transport as well as in the rail, ports and airports space.

Explore NTRO's services and expertise in the areas of future fuels, EVs and the future of mobility here: https://www.ntro.org.au/future-fuels.

References

[1] The Guardian (2023); [2] News Corp Australia (2022); [3] The Driven (2022); [4] Electric Vehicle Council (2023); [5] Bureau of Infrastructure and Transport Research Economics (2023); [6] Electric Vehicle Council (2022); [7] PlugShare (2023); [8] International Energy Agency (2022); [9] NRMA (2023); [10] Department of Climate Change, Energy, the Environment and Water (2023); [11] German Federal Network Agency (2023a); [12] NOBIL (2023); [13] German Federal Network Agency (2023b).