Australia currently generates just over 62 million tonnes of waste material annually, of which close to 40 million tonnes is recovered through waste/recycled materials suppliers and processors.

However, supply capacity is not uniform across material types, with a mix of common and specific issues causing shortages of some types and limiting supply growth.

ARRB in partnership with EY, recently delivered the Replacement Materials report as part of Infrastructure Australia’s Market Capacity Program.

The research analyses the market for recycled materials for major infrastructure road projects, identifying market constraints and opportunities to address these.

With engagement of over 350 industry and government leaders, the research found:

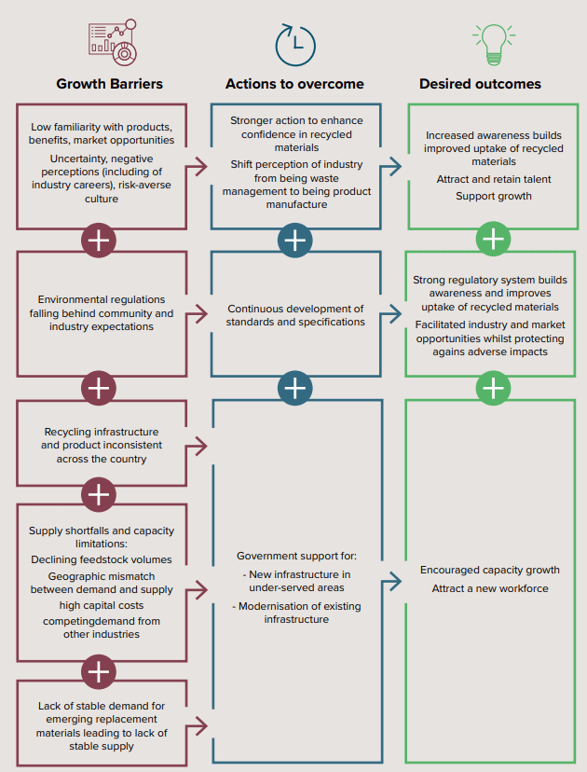

- There is a low familiarity of available recycled material products, benefits and market opportunities across the resource recovery and recycling industry.

- Uncertainty, negative perceptions, and a risk aversion culture are key barriers to uptake.

- Environmental regulations are falling behind community and industry expectations and inhibit industry growth.

- Recycling infrastructure and availability of replacement product is not consistent or uniform across the country.

- Supply shortfalls currently exist for fly ash, plastics, recycled crushed glass, and ground granulated blast furnace slag. Recycled crushed glass and ground granulated blast furnace slag have the greatest risk to future shortages.

- Supply capacity limitations include declining feedstock volumes, geographic mismatch between demand and supply, high capital costs, lack of demand and competing demand from other industries.

- Whilst stockpiles of crumb rubber currently exist, lack of demand for this material as well as a lack of uniform availability is creating challenges for uptake.

- Lack of sustainable and ongoing demand for emerging replacement materials are a key reason for the lack of stable supply.

The engagement program revealed five key opportunities to address market constraints impacting the uptake of recycled materials in road infrastructure which include:

- Improving awareness and understanding of recycled materials, specification and opportunities - continued emphasis on the development of standards and specifications, which can support their use, as well as building awareness through education and knowledge sharing are key to overcoming these challenges

- Taking stronger action to enhance confidence in using recycled materials, including developing and delivering education and awareness programs, developing and updating specifications and standards and driving cultural changes to reward innovation.

- Addressing regulatory issues to facilitate industry development, advance market opportunities and grow the circular economy, whilst protecting against adverse impacts

- Improving and modernising recycling infrastructure and workforce capacity and expanding geographic reach with government assistance in new and emerging markets

- Driving demand through sustainable procurements and market signalling, including accommodating cost impacts of replacement materials in public procurement tenders, provisioning supporting infrastructure standards and specifications in most jurisdictions, provisioning easily accessible supplier and cost information and addressing concerns for the safety and performance impacts of the materials.

To read the full report, click here.

The research also delivered up-to-date estimates on the opportunity to use recycled materials in major infrastructure road projects. To read more about the demand modelling, click here.

To find out how ARRB can assist you to incorporate recycled materials in your road infrastructure, click here.